You only need an hour a month to manage your finances.

Personal finance should be easy. After some initial work, automation should allow you to take a hands-off approach. And I mean hands-off literally. As in no touching your phone or computer to log in to a banking app to transfer funds every month. Most things personal-finance-wise should happen automatically.

6 Steps

How do you get there?

Unfortunately you can’t just click your fingers or wave your phoenix-feather-core wand or vigorously rub a lamp and all of a sudden you basically don’t check your finances anymore. It requires some upfront work:

- If you’re in (most types of) debt, work out how you’re going to pay off that debt.

- Audit your financial statements to see how much you currently spend.

- Determine significant areas of spending that you don’t care about and cut this spending ruthlessly.

- After this reduction, calculate how much you have left over from your income at the start of the month after a typical month of spending.

- Split this amount into short-term savings, goal-based/medium-term savings, and long-term investing.

- Set up automatic transfers and direct debits to pay your bills, followed by transfers to each of these savings/investing accounts, with the remaining balance being what you have to spend for that month.

80%

This up-front work, combined with an hour a month of monitoring accounts, will get you 80% there, which will put you in the top 5% of personal finance competency.

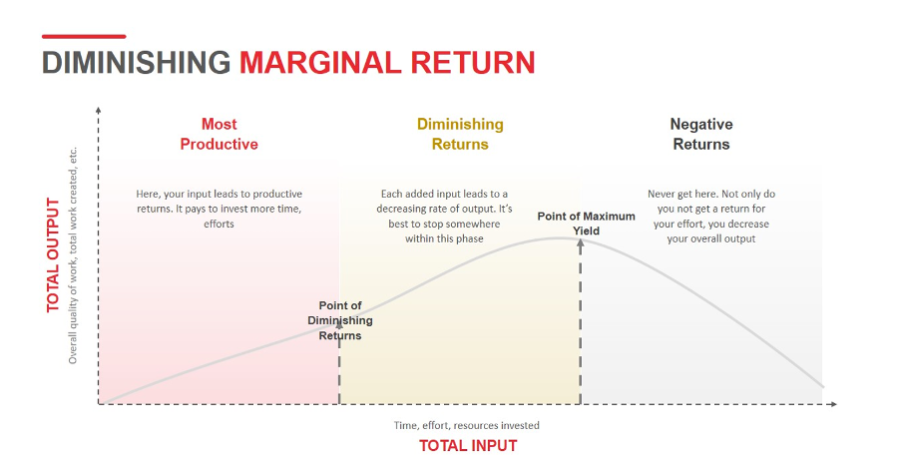

This is an example of the well-known idea that usually 80% of the results can be generated by 20% of the effort. This technique (the Pareto principle AKA the 80/20 rule) is a consequence of diminishing marginal returns. We identify a point at which extra effort is not worth the extra investment, and we stop there. The return on time spent simply isn’t appealing – remember, time is an investment, too.

Source: PowerSlides. Link: https://powerslides.com/product-tag/diminishing-marginal-return/

After this basic structure you can start to consider how (and why) to invest properly, how to save more by increasing income or further reducing expenditures, and other niche areas like taxes. Adding these components will get you to 95%.

The extra mile

The more astute of you may have noticed that this still leaves 5%.

“What about this last 5%?”, you may be asking, “How do I ‘complete’ personal finance and investing?”

It’s probably not worth your time to try.

Because markets, and planet Earth in general, are pretty efficient places. Finding some way to generate more money by doing something fancy is difficult, because most of these ways are already known about and exploited. You have to go all-in, medium commitment won’t cut it. In fact, medium could be worse than a low-effort approach.

Example: imagine you decide to start investing in options. A low-effort approach would be to simply, wisely, not do this. But you are, of course, different. You can use these financial instruments to generate extra returns. To do this profitably (without getting lucky) requires an edge – psychological, analytical, or informational. You really have to know what you’re doing. This requires a huge amount of time or intelligence or connections or something else exceptional.

Someone who doesn’t know what they’re doing but still participates has a medium-effort approach. They learn the basics about options. They learn the terms and how they work and how to trade them. But they don’t know enough – and subsequently lose their (size medium) shirt.

The low-effort person doesn’t trade and is hence neutral. The medium-effort person loses. The high-effort person wins. And if you think about time invested as a cost, it’s possible that the high-effort person loses, too.

This is why, if you’re going to attempt to generate excess returns, or find some type of tax loophole, or something else similarly fancy, you should probably be one of those freaks who actually takes pleasure in the activity. One of those weirdos who actually finds this stuff interesting and, maybe, God forbid, fun.

Pair this with a sensible approach to risk management. Initially only invest very small amounts, and even when you do feel confident – never bet the house.

Going after this final 5% can work. But I would seriously consider the time required to do so, as well as if you actually enjoy the process.

how to get lasuna without a prescription – where to buy himcolin without a prescription purchase himcolin pill

order besifloxacin sale – purchase carbocysteine pills buy sildamax online

cheap gabapentin – order nurofen sale azulfidine 500mg tablet

probalan cheap – purchase benemid online cheap order carbamazepine 400mg online

buy celebrex for sale – indocin 75mg drug cheap indomethacin

buy mebeverine generic – etoricoxib 60mg sale cilostazol online buy

buy diclofenac without prescription – purchase aspirin without prescription aspirin 75mg tablet

buy rumalaya cheap – buy rumalaya tablets order elavil 10mg online cheap

mestinon sale – pyridostigmine tablet purchase imuran online cheap

buy baclofen 25mg sale – order piroxicam generic feldene 20mg

order voveran online cheap – voveran oral nimotop over the counter

buy cyproheptadine 4 mg generic – tizanidine cost tizanidine buy online

mobic pills – buy ketorolac online oral ketorolac

cost cefdinir 300 mg – cleocin drug

cost deltasone 10mg – prednisolone 10mg sale buy permethrin sale

buy generic permethrin for sale – brand acticin cost tretinoin gel

betamethasone 20gm over the counter – benoquin sale purchase monobenzone cream

buy flagyl generic – buy generic metronidazole order cenforce 50mg pills

augmentin oral – order augmentin 1000mg generic purchase levoxyl generic

This is also a very good article which I really enjoy reading. Keep writing, thanks 온라인카지노사이트

This is actually a great and useful piece of information. Appreciate it! 메이저사이트

Thanks For sharing such valuable information.

토토사이트

Your blog have nice information, I got good ideas from this amazing blog.

파워볼사이트 추천

This is awesome, thanks a lot!파워볼사이트 추천

cost cleocin 150mg – indocin 75mg tablet buy indomethacin generic

cozaar 50mg pill – purchase keflex generic cephalexin 125mg over the counter

eurax for sale online – buy mupirocin aczone online

order Rybelsus https://rybelsus.tech/# cheap Rybelsus 14 mg

rybelsus cost

order generic modafinil – order provigil 100mg meloset uk

Muchas gracias. ?Como puedo iniciar sesion?

buy generic bupropion for sale – buy shuddha guggulu cheap buy shuddha guggulu no prescription

xeloda order online – cheap ponstel generic order danocrine 100 mg for sale

buy generic progesterone 100mg – where can i buy fertomid clomiphene online

buy alendronate without prescription – where can i buy tamoxifen buy medroxyprogesterone 5mg

buy aygestin no prescription – buy generic lumigan online buy yasmin tablets

buy generic estrace – anastrozole oral purchase anastrozole sale

buy rybelsus: buy rybelsus rybpharm – rybpharm cheap semaglutide

https://erepharm.com/# cheapest ed pills ere pharm

ed pills: cheapest ed pills ere pharm – cheapest ed pills ere pharm

dostinex 0.25mg tablet – brand premarin 0.625mg buy alesse online

Buy gabapentin for humans buy gabapentin gabapentin

http://furpharm.com/# furosemide

http://furpharm.com/# furpharm

rybpharm canada: rybpharm canada – rybpharm

furosemide fur pharm: lasix – buy lasix fur pharm

ED pills non prescription ere pharm best ed pills online

pharmacy website india: indian pharmacy easy – п»їlegitimate online pharmacies india

https://indianpharmacyeasy.com/# indian pharmacy

Online medicine order: Indian online pharmacy ship to usa – top 10 pharmacies in india

https://mexicanpharmgate.com/# mexican online pharmacies prescription drugs

https://indianpharmacyeasy.com/# indian pharmacy

http://canadiandrugsgate.com/# erectile dysfunction medications

http://indianpharmacyeasy.com/# world pharmacy india

mexican rx online: mexican pharmacy online medications – mexican online pharmacies prescription drugs

online pharmacy india: indianpharmacyeasy.com – top 10 online pharmacy in india

https://indianpharmacyeasy.com/# world pharmacy india

mexican online pharmacies prescription drugs Mexican Pharmacy Gate mexico pharmacies prescription drugs

https://canadiandrugsgate.com/# online canadian pharmacy

http://indianpharmacyeasy.com/# buy prescription drugs from india

ed meds online without doctor prescription: Best Canadian pharmacy – non prescription ed pills

indian pharmacy paypal: Online medicine home delivery – Online medicine home delivery

best online pharmacy india indianpharmacyeasy best online pharmacy india

https://indianpharmacyeasy.com/# india pharmacy

http://mexicanpharmgate.com/# buying prescription drugs in mexico

how to get prescription drugs without doctor: Canada pharmacy – cheap medications

india pharmacy mail order: Indian pharmacy to USA – top 10 pharmacies in india

http://indianpharmacyeasy.com/# top 10 pharmacies in india

herbal remedies for ed: canadian pharmacy drugs gate – ed pills online

mexican online pharmacies prescription drugs mexico pharmacy mexican rx online

https://mexicanpharmgate.com/# medication from mexico pharmacy

buy prescription drugs from india: Online medicine home delivery – mail order pharmacy india

п»їbest mexican online pharmacies: mexican pharmacy – reputable mexican pharmacies online

can i buy amoxicillin online http://clomidrexpharm.com/# where to get clomid

amoxicillin 500mg capsules: amoxicillin from canada – amoxicillin price without insurance

amoxicillin 500mg capsule buy online: buy amoxil online – amoxicillin 500 mg tablet

can i order generic clomid: clomid online – can i get clomid

buy amoxicillin online with paypal http://priligymaxpharm.com/# buy priligy

cheap priligy priligy maxpharm Priligy tablets

гѓ—гѓ¬гѓ‰гѓ‹гѓі и–¬е±ЂгЃ§иІ·гЃ€г‚‹ – гѓ—гѓ¬гѓ‰гѓ‹гѓі и–¬е±ЂгЃ§иІ·гЃ€г‚‹ г‚ўг‚ёг‚№гѓгѓћг‚¤г‚·гѓійЂљиІ©гЃЉгЃ™гЃ™г‚Ѓ

buy prednisone without prescription: 50 mg prednisone canada pharmacy – prednisone brand name india

where to get cheap clomid without a prescription: clomid purchase online rex pharm – buying cheap clomid without insurance

buying cheap clomid without dr prescription generic clomid where can i get generic clomid

priligy max pharm: buy priligy max pharm – cheap priligy

get cheap clomid without insurance: can you buy generic clomid tablets – can i buy cheap clomid price

clomid buy: rexpharm – how to buy cheap clomid no prescription

amoxicillin no prescipion https://priligymaxpharm.com/# cheap priligy

amoxicillin 875 125 mg tab: com pharm – can i buy amoxicillin online

how to get clomid price: generic clomid – where to get clomid price

г‚·гѓ«гѓ‡гѓЉгѓ•г‚Јгѓ« гЃЇйЂљиІ©гЃ§гЃ®иіј – バイアグラ еЂ¤ж®µ г‚·г‚ўгѓЄг‚№ и–¬е±ЂгЃ§иІ·гЃ€г‚‹

prednisone 300mg: prednisone ray pharm – prednisone buy cheap

can i order generic clomid without dr prescription: buy clomid – where to get cheap clomid without dr prescription

where can i get generic clomid without prescription: clomid online – where can i buy generic clomid without a prescription

how to get prednisone tablets: raypharm – prednisone 20mg prescription cost

medicine in mexico pharmacies https://mexicanpharmgate.com/ buying prescription drugs in mexico

plavix best price: PlavixClo Best Price – Plavix 75 mg price

Cost of Plavix on Medicare buy Plavix Clo Clopidogrel 75 MG price

purple pharmacy mexico price list http://mexicanpharmgate.com/ mexican pharmaceuticals online

prednisone drug costs: buy prednisone – generic prednisone tablets

https://iverfast.com/# ivermectin 18mg

buy Clopidogrel over the counter: PlavixClo Best Price – Plavix 75 mg price

prednisone uk: buy prednisone – prednisone 4 mg daily

Cytotec 200mcg price cyt premium buy cytotec online fast delivery

cytotec online: cheapest cytotec – cytotec buy online usa

http://cytpremium.com/# buy cytotec over the counter

where can i buy generic clomid pills: clomid rex pharm – where can i get cheap clomid without insurance

buy stromectol online: IverFast – price of ivermectin

minocycline for rosacea buy Stromectol ivermectin 400 mg brands

order amoxicillin online no prescription: over the counter amoxicillin – amoxicillin 500 mg tablet price

https://plavixclo.com/# plavix medication

order clomid without dr prescription: cheap clomid – can you get generic clomid for sale

plavix best price buy plavix online generic plavix

https://iverfast.com/# ivermectin 3mg dose

гѓ—гѓ¬гѓ‰гѓ‹гѓігЃЇи–¬е±ЂгЃ§иІ·гЃ€г‚‹пјџ – г‚ўг‚ュテイン её‚иІ© гЃЉгЃ™гЃ™г‚Ѓ жЈи¦Џе“Ѓг‚¤г‚Ѕгѓ€гѓ¬гѓЃгѓЋг‚¤гѓійЊ гЃ®жЈгЃ—い処方

buy misoprostol over the counter: buy cytotec cytpremium – buy cytotec online

can you get cheap clomid without a prescription: generic clomid – where to get generic clomid price

vavada: вавада казино – вавада казино

пинап казино: пин ап зеркало – pinup

вавада вавада вавада казино

пинап казино: pinup – пин ап казино

пин ап казино: пин ап казино онлайн – пин ап кз

пин ап вход: пин ап казино – пин ап вход

пин ап казино онлайн: pinup – pinup kazi

https://pinup-kazi.ru/# pinup kazi

vavada kazi: вавада – вавада

казино вавада: вавада казино онлайн – вавада

пин ап зеркало: pinup kazi – pinup

вавада казино онлайн: вавада онлайн казино – вавада казино

https://pinup-kazi.ru/# пинап казино

pinup-kazi.ru: пин ап казино – пин ап казино

вавада: вавада – vavada kazi

пинап казино: pinup kazi – pinup-kazi.kz

pinup-kazi.ru пин ап вход пин ап казино официальный сайт

вавада казино онлайн: казино вавада – вавада казино

vavada: вавада онлайн казино – вавада казино

https://vavada-kazi.ru/# вавада казино зеркало

пин ап кз: пин ап казино онлайн – pinup

pin up казино: pinup – pinup-kazi.kz

вавада: vavada kazi – vavada kazi

pinup-kazi.kz pin up казино пин ап кз

pinup-kazi.ru: пинап казино – pinup

mexican border pharmacies shipping to usa mexicanpharmeasy.com best online pharmacies in mexico

impotence treatment https://canadianpharm1st.com/# otc ed drugs

Online medicine order: indian pharm star – cheapest online pharmacy india

indian pharmacies safe: indian pharmacy – reputable indian pharmacies

buying from online mexican pharmacy: MexicanPharmEasy – п»їbest mexican online pharmacies

indian pharmacy paypal indian pharm cheapest online pharmacy india

best online pharmacies in mexico: Pharm Easy – buying from online mexican pharmacy

medication from mexico pharmacy: mexican pharm easy – best online pharmacies in mexico

pharmacies in mexico that ship to usa: Mexican Pharm – п»їbest mexican online pharmacies

mail order pharmacy india IndianPharmStar top online pharmacy india

pharmacies in mexico that ship to usa: Mexican Pharm – mexican mail order pharmacies

mexico drug stores pharmacies: mexican pharm easy – buying prescription drugs in mexico online

can ed be cured https://mexicanpharmeasy.com/# pharmacies in mexico that ship to usa

cheapest ed pills: canadian pharm 1st – pills for erection

buying prescription drugs in mexico mexican pharm easy buying prescription drugs in mexico online

buying from online mexican pharmacy: MexicanPharmEasy – mexican mail order pharmacies

mexico drug stores pharmacies: MexicanPharmEasy – best online pharmacies in mexico

natural drugs for ed http://mexicanpharmeasy.com/# mexico drug stores pharmacies

mexican pharmacy without prescription: canadianpharm1st.com – mens ed

top 10 online pharmacy in india indian pharmacy indian pharmacy paypal

cheapest online pharmacy india: indian pharm – indian pharmacy online

natural cures for ed https://canadianpharm1st.com/# otc ed drugs

online pharmacy india: indian pharm – п»їlegitimate online pharmacies india

Online medicine order: indian pharm – india pharmacy

Online medicine order indian pharmacy indian pharmacies safe

mexican mail order pharmacies: mexican pharmacy – buying prescription drugs in mexico

natural ed medications https://canadianpharm1st.com/# medication online

vacuum pumps for ed: canadian pharm – overcoming ed

top online pharmacy india IndianPharmStar Online medicine order

do i have ed: canadianpharm1st – drugs causing ed

п»їbest mexican online pharmacies: mexicanpharmeasy.com – mexico pharmacies prescription drugs

pharmacy website india: indian pharmacy – indianpharmacy com

best natural cure for ed http://canadianpharm1st.com/# ed help

buying from online mexican pharmacy: MexicanPharmEasy – purple pharmacy mexico price list

india pharmacy indian pharm star mail order pharmacy india

indian pharmacy paypal: IndianPharmStar – top online pharmacy india

ed pharmacy http://mexicanpharmeasy.com/# pharmacies in mexico that ship to usa

best online pharmacies in mexico: mexicanpharmeasy.com – mexican pharmaceuticals online

real cialis without a doctor’s prescription canadian pharm ed treatment review

ivermectin oral solution: Ivermectin Pharm – ivermectin cream uk

http://gabapentinpharm.com/# order neurontin over the counter

Ivermectin Pharm: Ivermectin Pharm – Ivermectin Pharm Store

neurontin buy from canada Gabapentin Pharm generic neurontin

п»їpaxlovid: Paxlovid.ink – Paxlovid.ink

https://ivermectinpharm.store/# order minocycline 50mg online

eriacta cigarette – eriacta play forzest shudder

neurontin tablets 100mg: gabapentin 100mg – Gabapentin Pharm

neurontin 100mg: neurontin brand coupon – neurontin sale

https://amoxilpharm.store/# generic amoxil 500 mg

Paxlovid.ink: Paxlovid.ink – Paxlovid.ink

Gabapentin Pharm: Gabapentin Pharm – neurontin 100mg caps

paxlovid pharmacy: paxlovid covid – Paxlovid.ink

https://semaglutidepharm.com/# rybelsus

rybelsus: cheap Rybelsus 14 mg – cheap Rybelsus 14 mg

rybelsus: semaglutide pharm – buy rybelsus

semaglutide cheap Rybelsus 14 mg Buy semaglutide pills

http://amoxilpharm.store/# amoxicillin 500 mg brand name

Paxlovid.ink: Paxlovid.ink – Paxlovid.ink

Amoxil Pharm Store: AmoxilPharm – amoxicillin 500 tablet

http://amoxilpharm.store/# Amoxil Pharm Store

AmoxilPharm: buy amoxicillin 500mg online – Amoxil Pharm Store

http://paxlovid.ink/# paxlovid buy

Ivermectin Pharm Store: buy minocycline 50mg online – buy stromectol canada

AmoxilPharm: Amoxil Pharm Store – Amoxil Pharm Store

http://amoxilpharm.store/# amoxicillin generic brand

Ivermectin Pharm Store Ivermectin Pharm Store Ivermectin Pharm Store

https://lisinoprilus.com/# lisinopril 20 mg brand name

can i buy zithromax online: zithromax order online uk – where to get zithromax

ciprofloxacin: cipro ciprofloxacin – cipro

buy cipro no rx buy cipro online usa buy cipro no rx

get cheap clomid for sale: cost of cheap clomid tablets – can i get clomid without insurance

https://lisinoprilus.com/# lisinopril 20mg tablets

lisinopril 20 lisinopril 5mg prices price of zestril 30 mg

cipro ciprofloxacin: buy cipro online – buy cipro cheap

https://cytotec.top/# buy cytotec pills

can i purchase generic clomid pill: cheap clomid without a prescription – where can i get clomid

buy cipro without rx where to buy cipro online purchase cipro

https://lisinoprilus.com/# prinivil lisinopril

ciprofloxacin 500 mg tablet price: cipro online no prescription in the usa – cipro for sale

order cheap clomid: how to buy cheap clomid price – where buy cheap clomid without rx

http://ciprofloxacin.cheap/# buy cipro no rx

buy azithromycin zithromax buy generic zithromax online zithromax 250 mg

buy cipro online canada: ciprofloxacin generic price – ciprofloxacin generic

https://ciprofloxacin.cheap/# purchase cipro

lisinopril 60 mg daily lisinopril 125 mg buy 40 mg lisinopril

where can i buy zithromax in canada: zithromax 500 mg for sale – zithromax capsules price

https://lisinoprilus.com/# where can i order lisinopril online

buy cytotec over the counter: buy cytotec in usa – cytotec abortion pill

http://ciprofloxacin.cheap/# buy cipro online usa

Cytotec 200mcg price: order cytotec online – Cytotec 200mcg price

zestoretic online lisinopril 10 mg brand name in india lisinopril 200 mg

order cytotec online: buy cytotec pills online cheap – buy cytotec over the counter

https://clomid.store/# can i get generic clomid no prescription

buy cipro no rx: where can i buy cipro online – cipro 500mg best prices

zithromax 500 mg: buy zithromax – where can you buy zithromax

zithromax prescription online generic zithromax india where can i purchase zithromax online

https://azithromycinus.com/# purchase zithromax z-pak

how to get indinavir without a prescription – order emulgel sale order voltaren gel online

get generic clomid now: cost of cheap clomid without a prescription – cost of generic clomid tablets

zithromax 250 mg australia: zithromax over the counter canada – zithromax 500

lisinopril 10 mg cost lisinopril 40 coupon order lisinopril online us

https://lisinoprilus.com/# buy lisinopril 10 mg online

where to buy cipro online: ciprofloxacin 500 mg tablet price – cipro pharmacy

п»їcytotec pills online: cytotec pills buy online – buy cytotec pills online cheap

zithromax without prescription zithromax capsules price zithromax capsules australia

ciprofloxacin over the counter: buy cipro online without prescription – ciprofloxacin

http://lisinoprilus.com/# lisinopril 10 mg pill

buy lisinopril online uk: buy lisinopril 20 mg without a prescription – buy lisinopril no prescription

buy lisinopril online india lisinopril prescription lisinopril 40 coupon

https://clomid.store/# get clomid without rx

buy lisinopril online: lisinopril diuretic – lisinopril tablets

valif pills thin – oral sinemet 20mg order sinemet 10mg sale

cytotec buy online usa buy cytotec pills Misoprostol 200 mg buy online

https://lisinoprilus.com/# lisinopril 20 mg tablet price

https://semaglutidetablets.store/# semaglutide best price

https://kamagra.men/# Kamagra 100mg price

ed medications online: low cost ed meds online – ed medicine online

can ed be reversed: drugs1st – erection pills

https://kamagra.men/# sildenafil oral jelly 100mg kamagra

cenforce for sale order cenforce buy cenforce

http://edpills.men/# generic ed meds online

drugs1st: drugs1st – cheap drugs online

http://kamagra.men/# Kamagra 100mg price

semaglutide tablets store: semaglutide best price – buy semaglutide

http://kamagra.men/# Kamagra 100mg price

https://kamagra.men/# Kamagra Oral Jelly

homepage: ed doctor – drugs1st

http://semaglutidetablets.store/# semaglutide tablets store

https://cenforce.icu/# cenforce for sale

п»їkamagra: buy kamagra online usa – Kamagra tablets

Kamagra 100mg: Kamagra 100mg price – Kamagra tablets

https://edpills.men/# erectile dysfunction meds online

Cenforce 150 mg online cheapest cenforce Buy Cenforce 100mg Online

https://drugs1st.pro/# impotance

http://drugs1st.pro/# drugs1st

semaglutide best price: semaglutide best price – buy semaglutide

semaglutide tablets: semaglutide best price – cheap semaglutide pills

https://edpills.men/# cost of ed meds

http://kamagra.men/# Kamagra Oral Jelly

tГјrk partner siteleri betboo giriЕџ yeni bahis siteleri deneme bonusu

slot siteleri: az parayla cok kazandiran slot oyunlar? – slot oyunlar?

https://pinup2025.com/# пинап казино

пин ап вход: пинап казино – пин ап

http://pinup2025.com/# пин ап казино

http://casinositeleri2025.pro/# gГјvenilir canlД± bahis casino siteleri

az parayla cok kazandiran slot oyunlar? en cok kazand?ran slot oyunlar? slot tr online

пинап казино: pinup 2025 – pinup 2025

http://pinup2025.com/# пин ап казино зеркало

pinup 2025: pinup2025.com – pinup 2025

pinup 2025 пинап казино пин ап казино

ilk giriЕџte bonus veren bahis siteleri: en gГјvenilir casino siteleri – 2025 yatД±rД±m ЕџartsД±z deneme bonusu veren siteler

https://pinup2025.com/# pinup 2025

http://pinup2025.com/# пин ап казино официальный сайт

пин ап казино официальный сайт пин ап казино зеркало пин ап вход

slot oyunlar? puf noktalar?: az parayla cok kazandiran slot oyunlar? – en cok kazand?ran slot oyunlar?

https://slottr.top/# slot tr online

пинап казино: пин ап – pinup 2025

https://pinup2025.com/# пин ап

http://slottr.top/# slot siteleri

az parayla cok kazandiran slot oyunlar? slot tr online slot oyunlar?

pinup 2025: пин ап зеркало – пинап казино

http://casinositeleri2025.pro/# deneme bonusu veren slot siteleri 2025

az parayla cok kazandiran slot oyunlar?: slot oyunlar? – slot siteleri

hangi bahis siteleri bonus veriyor? gГјvenilir oyun siteleri orisbet giriЕџ

18siteler: casino malta – kazino online

http://slottr.top/# slot oyunlar? puf noktalar?

http://slottr.top/# slot tr online

http://slottr.top/# slot tr online

slot oyunlar? az parayla cok kazandiran slot oyunlar? slot oyunlar?

rcasino: casimo – en az para yatД±rД±lan bahis siteleri

brand provigil – buy modafinil cheap purchase combivir

pinup2025.com: пин ап казино – пинап казино

az parayla cok kazandiran slot oyunlar? en cok kazand?ran slot oyunlar? slot oyunlar?

https://slottr.top/# slot oyunlar? puf noktalar?

como bakery yorumlarД±: en gГјvenilir casino siteleri – en gГјvenilir online casino

http://casinositeleri2025.pro/# en gГјvenilir bahis siteleri hangileri?

http://pinup2025.com/# пинап казино

az parayla cok kazandiran slot oyunlar? en kazancl? slot oyunlar? az parayla cok kazandiran slot oyunlar?

пин ап казино официальный сайт: пин ап казино официальный сайт – пинап казино

pinup2025.com: пин ап казино официальный сайт – пин ап казино официальный сайт

https://pinup2025.com/# пинап казино

bedbo en iyi bahis sitesi hangisi casino maxi

bilinmeyen bahis siteleri: tГјrkiye casino siteleri – 30 tl bonus veren bahis siteleri

https://pinup2025.com/# пин ап зеркало

slot siteleri: az parayla cok kazandiran slot oyunlar? – slot tr online

en kazancl? slot oyunlar? en cok kazand?ran slot oyunlar? en kazancl? slot oyunlar?

https://casinositeleri2025.pro/# slot oyunlarД±

pinup 2025: пин ап вход – пин ап казино зеркало

http://pinup2025.com/# pinup 2025

пин ап казино pinup 2025 пин ап казино

пин ап зеркало: пин ап казино зеркало – пин ап зеркало

en cok kazand?ran slot oyunlar?: en cok kazand?ran slot oyunlar? – slot oyunlar? puf noktalar?

http://casinositeleri2025.pro/# curacao lisans siteleri

india online pharmacy indiapharmi Online medicine home delivery

https://mexicanpharmi.com/# pharmacies in mexico that ship to usa

reputable indian online pharmacy: Best Indian pharmacy – indian pharmacy online

https://indiapharmi.com/# best india pharmacy

mexico drug stores pharmacies: Purple pharmacy online ordering – pharmacies in mexico that ship to usa

https://canadianpharmi.com/# male dysfunction pills

online shopping pharmacy india Online India pharmacy buy medicines online in india

https://indiapharmi.com/# india online pharmacy

http://canadianpharmi.com/# pills erectile dysfunction

buying prescription drugs in mexico: Legit online Mexican pharmacy – medicine in mexico pharmacies

best india pharmacy: indian pharmacy – indian pharmacy

pharmacies in mexico that ship to usa Purple pharmacy online ordering mexican border pharmacies shipping to usa

https://canadianpharmi.com/# best erectile dysfunction pills

http://mexicanpharmi.com/# purple pharmacy mexico price list

online pharmacy india: Top online pharmacy in India – pharmacy website india

http://mexicanpharmi.com/# mexico drug stores pharmacies

india online pharmacy Online India pharmacy Online medicine home delivery

http://indiapharmi.com/# indian pharmacies safe

top online pharmacy india: Top online pharmacy in India – top 10 online pharmacy in india

https://canadianpharmi.com/# over the counter ed medication

mexico drug stores pharmacies: Legit online Mexican pharmacy – buying from online mexican pharmacy

best online pharmacies in mexico Mexican pharmacy ship to usa mexican mail order pharmacies

http://canadianpharmi.com/# best ed treatments

http://canadianpharmi.com/# erectile dysfunction natural remedies

reputable mexican pharmacies online: Legit online Mexican pharmacy – best online pharmacies in mexico

https://mexicanpharmi.com/# mexican border pharmacies shipping to usa

best online pharmacies in mexico: mexicanpharmi – п»їbest mexican online pharmacies

mexican border pharmacies shipping to usa Mexican pharmacies that ship to the United States best online pharmacies in mexico

http://canadianpharmi.com/# best medication for ed

amoxicillin without a doctor’s prescription: Canadian pharmacy prices – natural drugs for ed

india pharmacy mail order india pharmi п»їlegitimate online pharmacies india

Ищите в гугле

http://canadianpharmi.com/# herbal remedies for ed

https://canadianpharmi.com/# ed cure

online pharmacy india: Online India pharmacy – reputable indian pharmacies

medicine prednisone 10mg Predni Best where to get prednisone

https://clomidonpharm.com/# where to get clomid without dr prescription

amoxicillin canada price: buy amoxicillin online mexico – amoxicillin 500mg without prescription

http://prednibest.com/# prednisone purchase online

ciprofloxacin order online: buy ciprofloxacin – ciprofloxacin 500 mg tablet price

http://cipharmdelivery.com/# ciprofloxacin over the counter

prednisone online sale prednisone in uk prescription prednisone cost

ivermectin 6mg pills for humans – ivermectin 12mg stromectol buy tegretol 200mg online cheap

https://amoxstar.com/# amoxicillin 500 mg tablet price

amoxicillin 500 mg without prescription: AmoxStar – buy amoxicillin 500mg

where to buy amoxicillin over the counter Amox Star generic amoxicillin 500mg

https://prednibest.com/# prednisone in canada

amoxicillin 500mg capsule Amox Star amoxicillin 500mg for sale uk

http://clomidonpharm.com/# can you buy clomid without dr prescription

http://clomidonpharm.com/# can i get generic clomid online

amoxicillin without a prescription: can you buy amoxicillin over the counter – buy amoxicillin online no prescription

clomid without insurance: clomidonpharm – can you buy generic clomid for sale

amoxicillin 500 mg for sale AmoxStar amoxicillin tablet 500mg

http://cipharmdelivery.com/# ciprofloxacin 500 mg tablet price

where to get cheap clomid without dr prescription: where to buy generic clomid for sale – cost cheap clomid now

prednisone 10mg tabs: PredniBest – purchase prednisone from india

prednisone 20mg prices PredniBest prednisone 2.5 mg daily

http://prednibest.com/# prednisone 30 mg coupon

prednisone 20mg tablets where to buy: prednisone 20mg online without prescription – canine prednisone 5mg no prescription

amoxicillin where to get Amox Star cost of amoxicillin 30 capsules

https://amoxstar.com/# can you buy amoxicillin over the counter canada

cost generic clomid pill: buying clomid – can i buy generic clomid without a prescription

can you buy prednisone without a prescription: Predni Best – buy prednisone online without a prescription

where to get clomid without insurance clomid on pharm can i purchase generic clomid prices

https://clomidonpharm.com/# how can i get clomid

prednisone 20 mg without prescription: Predni Best – buy prednisone 20mg without a prescription best price

п»їcipro generic: cipro – cipro for sale

http://cipharmdelivery.com/# buy cipro online canada

prednisone buy Predni Best generic prednisone for sale

cost cheap clomid without insurance: how to get clomid without a prescription – order clomid without dr prescription

https://cipharmdelivery.com/# ciprofloxacin generic price

buy cipro online ciprofloxacin generic antibiotics cipro

cheap clomid without a prescription: clomidonpharm – where to get generic clomid online

buying prednisone from canada: Predni Best – prednisone for cheap

https://prednibest.com/# 25 mg prednisone

order amoxicillin online uk AmoxStar purchase amoxicillin 500 mg

prednisone daily use: prednisone cream rx – buy prednisone tablets online

cipro: buy cipro online canada – п»їcipro generic

prednisone canada pharmacy Predni Best prednisone without prescription 10mg

https://prednibest.com/# online prednisone

prednisone 10 mg price: PredniBest – generic prednisone for sale

buy cipro cheap ciprofloxacin generic price ciprofloxacin over the counter

ciprofloxacin 500 mg tablet price: ci pharm delivery – ciprofloxacin generic

https://cipharmdelivery.com/# ciprofloxacin generic

п»їcipro generic: buy cipro – cipro 500mg best prices

buy prednisone online canada PredniBest where to buy prednisone without prescription

http://cipharmdelivery.com/# п»їcipro generic

amoxicillin pills 500 mg: amoxicillin online purchase – buy amoxicillin 500mg capsules uk

https://amoxstar.com/# amoxicillin 500mg buy online uk

https://gramster.ru/# pinup 2025

https://gramster.ru/# пин ап казино зеркало

пин ап зеркало Gramster пин ап

http://gramster.ru/# gramster.ru

https://gramster.ru/# пин ап вход

http://gramster.ru/# пинап казино

http://gramster.ru/# gramster.ru

пин ап казино официальный сайт: gramster – пин ап

pinup 2025 Gramster пин ап вход

deltasone 40mg without prescription – buy nateglinide generic order capoten for sale

https://gramster.ru/# gramster.ru

https://gramster.ru/# пин ап зеркало

gramster.ru: gramster – пинап казино

https://gramster.ru/# pinup 2025

http://gramster.ru/# пин ап казино официальный сайт

пин ап казино официальный сайт Gramster пин ап казино официальный сайт

https://gramster.ru/# pinup 2025

пин ап вход: gramster – пин ап казино зеркало

http://gramster.ru/# pinup 2025

https://gramster.ru/# пин ап зеркало

https://gramster.ru/# пинап казино

пин ап казино официальный сайт gramster пинап казино

gramster.ru: gramster – пин ап зеркало

https://gramster.ru/# пин ап зеркало

https://gramster.ru/# пин ап вход

http://gramster.ru/# пин ап казино зеркало

пин ап казино: gramster – пин ап казино

https://gramster.ru/# пин ап казино зеркало

pinup 2025 Gramster пин ап

http://gramster.ru/# пин ап казино официальный сайт

пин ап: gramster.ru – pinup 2025

https://gramster.ru/# пин ап вход

http://gramster.ru/# пин ап вход

http://gramster.ru/# пин ап вход

пин ап казино Gramster gramster.ru

https://gramster.ru/# пин ап

пин ап вход: gramster.ru – pinup 2025

https://gramster.ru/# pinup 2025

http://gramster.ru/# gramster.ru

https://gramster.ru/# пин ап казино официальный сайт

gramster.ru: gramster – пин ап зеркало

http://gramster.ru/# пин ап казино зеркало

http://gramster.ru/# pinup 2025

пин ап gramster.ru пин ап казино официальный сайт

http://gramster.ru/# pinup 2025

https://gramster.ru/# gramster.ru

https://gramster.ru/# gramster.ru

pinup 2025: gramster.ru – пин ап казино официальный сайт

http://gramster.ru/# pinup 2025

https://indianpharmacy.win/# cheapest online pharmacy india

pharmacy website india pharmacy website india india pharmacy mail order

http://canadianpharmacy.win/# canadian pharmacy 24

https://mexicanpharmacy.store/# mexican online pharmacies prescription drugs

pharmacy wholesalers canada: canadian drug stores – canadian valley pharmacy

https://canadianpharmacy.win/# safe online pharmacies in canada

http://mexicanpharmacy.store/# п»їbest mexican online pharmacies

https://canadianpharmacy.win/# my canadian pharmacy

india pharmacy buy medicines online in india online shopping pharmacy india

top 10 pharmacies in india: mail order pharmacy india – indian pharmacy

https://canadianpharmacy.win/# canadian online drugs

http://indianpharmacy.win/# india pharmacy mail order

https://canadianpharmacy.win/# canadian pharmacy price checker

http://indianpharmacy.win/# top 10 online pharmacy in india

Online medicine home delivery: india pharmacy – top 10 online pharmacy in india

best canadian online pharmacy best canadian online pharmacy global pharmacy canada

https://canadianpharmacy.win/# legit canadian pharmacy

https://mexicanpharmacy.store/# mexican pharmaceuticals online

https://indianpharmacy.win/# world pharmacy india

india pharmacy mail order: india pharmacy mail order – indian pharmacy paypal

http://mexicanpharmacy.store/# pharmacies in mexico that ship to usa

http://canadianpharmacy.win/# buy drugs from canada

https://indianpharmacy.win/# indian pharmacy

canadian pharmacy world best online canadian pharmacy canadianpharmacymeds com

https://canadianpharmacy.win/# canadian pharmacy reviews

india pharmacy mail order: online shopping pharmacy india – top 10 online pharmacy in india

https://indianpharmacy.win/# top online pharmacy india

http://indianpharmacy.win/# indianpharmacy com

https://canadianpharmacy.win/# canadian pharmacy reviews

https://canadianpharmacy.win/# canadian pharmacy oxycodone

ed drugs online from canada: best online canadian pharmacy – canadian pharmacy phone number

vipps approved canadian online pharmacy best canadian online pharmacy reliable canadian online pharmacy

https://mexicanpharmacy.store/# best online pharmacies in mexico

https://canadianpharmacy.win/# canadian neighbor pharmacy

http://canadianpharmacy.win/# reliable canadian pharmacy

indian pharmacies safe: india pharmacy – indian pharmacies safe

http://mexicanpharmacy.store/# medicine in mexico pharmacies

http://canadianpharmacy.win/# reputable canadian pharmacy

onlinecanadianpharmacy 24 canadian discount pharmacy canadian pharmacy 365

http://mexicanpharmacy.store/# buying prescription drugs in mexico online

indian pharmacies safe: top 10 pharmacies in india – indianpharmacy com

https://canadianpharmacy.win/# onlinepharmaciescanada com

http://indianpharmacy.win/# world pharmacy india

https://indianpharmacy.win/# indian pharmacies safe

mexican drugstore online mexican border pharmacies shipping to usa mexican border pharmacies shipping to usa

mail order pharmacy india: top online pharmacy india – indian pharmacy

https://canadianpharmacy.win/# best canadian pharmacy online

http://mexicanpharmacy.store/# mexican border pharmacies shipping to usa

https://canadianpharmacy.win/# canada rx pharmacy world

http://mexicanpharmacy.store/# mexican pharmaceuticals online

indianpharmacy com: india online pharmacy – best online pharmacy india

https://canadianpharmacy.win/# canadian pharmacy india

pharmacy website india Online medicine order best india pharmacy

http://canadianpharmacy.win/# safe canadian pharmacy

http://mexicanpharmacy.store/# purple pharmacy mexico price list

http://indianpharmacy.win/# india pharmacy

http://mexicanpharmacy.store/# medicine in mexico pharmacies

http://mexicanpharmacy.store/# purple pharmacy mexico price list

http://mexicanpharmacy.store/# medication from mexico pharmacy

top 10 online pharmacy in india online shopping pharmacy india india online pharmacy

Tadalafil price Buy Tadalafil 5mg cialis for sale

http://fastpillseasy.com/# buying erectile dysfunction pills online

http://fastpillsformen.com/# viagra without prescription

Viagra online price: Fast Pills For Men – Viagra Tablet price

http://fastpillsformen.com/# best price for viagra 100mg

Generic Viagra online: cheap viagra – order viagra

Generic Cialis price MaxPillsForMen.com п»їcialis generic

http://maxpillsformen.com/# Tadalafil Tablet

get ed meds online: erection pills online – cheapest ed medication

Cheap generic Viagra FastPillsForMen.com Cheap generic Viagra

Cialis without a doctor prescription: Generic Cialis without a doctor prescription – Buy Cialis online

http://fastpillseasy.com/# best online ed pills

https://fastpillseasy.com/# ed pills for sale

affordable ed medication cheap cialis cheapest online ed treatment

buy cialis pill: buy cialis pill – Generic Cialis without a doctor prescription

cheapest cialis: Max Pills For Men – cialis for sale

https://fastpillseasy.com/# where to get ed pills

http://fastpillseasy.com/# online ed pills

sildenafil 50 mg price: Order Viagra 50 mg online – over the counter sildenafil

https://fastpillseasy.com/# erectile dysfunction drugs online

https://maxpillsformen.com/# buy cialis pill

pills for ed online: FastPillsEasy – ed prescription online

Generic Cialis price Generic Cialis without a doctor prescription Tadalafil Tablet

online erectile dysfunction medication: FastPillsEasy – get ed meds online

https://maxpillsformen.com/# Generic Tadalafil 20mg price

online erectile dysfunction pills cheap cialis ed med online

https://fastpillseasy.com/# buying ed pills online

Generic Viagra online: FastPillsForMen.com – sildenafil over the counter

order viagra: Sildenafil Citrate Tablets 100mg – cheap viagra

http://fastpillsformen.com/# generic sildenafil

best online ed meds FastPillsEasy online erectile dysfunction pills

best online ed pills: fast pills easy – online erectile dysfunction medication

http://fastpillsformen.com/# Sildenafil 100mg price

cheapest cialis: Generic Cialis without a doctor prescription – Buy Tadalafil 20mg

http://fastpillseasy.com/# discount ed meds

http://maxpillsformen.com/# Cheap Cialis

low cost ed medication FastPillsEasy best online ed pills

Cheap Cialis: MaxPillsForMen.com – Cialis 20mg price in USA

https://fastpillseasy.com/# where can i get ed pills

https://maxpillsformen.com/# Tadalafil price

Buy Tadalafil 5mg MaxPillsForMen.com Buy Tadalafil 5mg

https://maxpillsformen.com/# Generic Tadalafil 20mg price

Cheap Viagra 100mg: FastPillsForMen – buy Viagra over the counter

Cheap generic Viagra online: cheap viagra – sildenafil over the counter

https://maxpillsformen.com/# cheapest cialis

Cheap Viagra 100mg FastPillsForMen.com Cheap generic Viagra online

https://fastpillsformen.com/# cheap viagra

buy ed pills online: buy erectile dysfunction medication – ed medications online

buy Viagra online: FastPillsForMen.com – over the counter sildenafil

Order Viagra 50 mg online cheapest viagra generic sildenafil

https://maxpillsformen.com/# Buy Cialis online

Buy Viagra online cheap: buy viagra online – cheap viagra

ed medicine online cheap cialis order ed pills

http://fastpillseasy.com/# where to get ed pills

buy cialis pill: Max Pills For Men – buy cialis pill

Viagra online price: cheap viagra – Order Viagra 50 mg online

Buy Tadalafil 20mg Cheap Cialis Generic Cialis price

http://fastpillseasy.com/# low cost ed medication

buy Viagra over the counter: FastPillsForMen.com – buy viagra here

La prima differenza sostanziale rispetto ai precedenti engine si nota subito all’avvio: questo è talmente leggero che è distribuito anche come eseguibile standalone che non necessita di essere installato. Ciò permette, a chi non ha un computer particolarmente performante, di lavorare senza dover aspettare caricamenti infiniti (i progetti Unity e di Unreal tendono a diventare pesanti molto in fretta). L’unione dei due team di sviluppo sembra essere nata non per migliorare la nuova SDK in sé, quanto per rendere Unity 3D più performante su Android, attraverso l’utilizzo e l’ottimizzazione unisona delle due piattaforme. Può sembrare strano che Google abbia scelto di migliorare un motore grafico in particolare, ma in realtà si tratta di una mossa molto intelligente poiché Unity è ampiamente utilizzato in moltissimi videogiochi per Android, se non persino nella maggioranza dei casi.

https://123-directory.com/listings12906657/software-giochi-gratis-per-pc

Il mondo dell’interactive entertainment, del gaming e degli esport è un grande mercato capace di muovere enormi investimenti, che richiede tutele efficaci e un’assistenza sempre al passo con le nuove tecnologie e normative. L’Associazione La Mongolfiera Onlus ha l’obiettivo di riconoscere, promuovere e valorizzare una cultura dell’accoglienza, della disabilità e della vita che metta al centro la persona nella sua piena dignità, fin dal concepimento e indipendentemente dallo stato di salute psicofisico e dall’eventuale condizione di disagio… Le termocoppie possono essere utilizzate anche in diverse applicazioni alimentari come le sonde a penetrazione e anche in controllo del forno. Uno strumento del genere sarebbe utile per gli operatori del settore alimentare e delle bevande ed è un componente molto necessario per le aziende che producono elettrodomestici da cucina o da cucina. Sono disponibili anche strumenti correlati come il calibratore per termocoppie e il registratore di dati per termocoppie a prezzi convenienti.

Generic Cialis without a doctor prescription Max Pills For Men Buy Tadalafil 5mg

https://casinositeleri25.com/# Casino Siteleri

deneme bonusu veren siteler yeni: deneme bonusu veren siteler yeni – yeni deneme bonusu veren siteler

http://casinositeleri25.com/# guvenilir casino siteleri

deneme bonusu veren siteler yeni: yat?r?ms?z deneme bonusu veren siteler – yat?r?ms?z deneme bonusu veren siteler

https://denemebonusuverensiteler25.com/# deneme bonusu veren yeni siteler

sweet bonanza kazanma saatleri sweet bonanza slot sweet bonanza slot

https://casinositeleri25.com/# Casino Siteleri

http://sweetbonanza25.com/# sweet bonanza slot

http://denemebonusuverensiteler25.com/# yeni deneme bonusu veren siteler

Canl? Casino Siteleri: canl? casino siteleri – canl? casino siteleri

slot oyunlar? puf noktalar?: slot oyunlar? – en cok kazand?ran slot oyunlar?

sweet bonanza kazanma saatleri sweet bonanza oyna sweet bonanza demo oyna

http://slotsiteleri25.com/# guvenilir slot siteleri

slot oyunlar? puf noktalar?: en cok kazand?ran slot oyunlar? – az parayla cok kazandiran slot oyunlar?

yeni deneme bonusu veren siteler deneme bonusu veren siteler yeni deneme bonusu veren yeni siteler

slot siteleri: en cok kazand?ran slot oyunlar? – en kazancl? slot oyunlar?

https://casinositeleri25.com/# canl? casino siteleri

Casino Siteleri: Casino Siteleri – guvenilir casino siteleri

sweet bonanza slot sweet bonanza oyna sweet bonanza

https://sweetbonanza25.com/# sweet bonanza demo oyna

deneme bonusu veren siteler yeni: deneme bonusu veren yeni siteler – yat?r?ms?z deneme bonusu veren siteler

slot casino siteleri: slot casino siteleri – slot oyunlar? puf noktalar?

slot oyunlar? slot casino siteleri en cok kazand?ran slot oyunlar?

https://denemebonusuverensiteler25.com/# denemebonusuverensiteler25

deneme bonusu veren casino siteleri: deneme bonusu veren casino siteleri – Casino Siteleri

en guvenilir casino siteleri guvenilir casino siteleri canl? casino siteleri

slot oyunlar?: en cok kazand?ran slot oyunlar? – slot siteleri

http://slotsiteleri25.com/# guvenilir slot siteleri

guvenilir slot siteleri slot oyunlar? guvenilir slot siteleri

en kazancl? slot oyunlar?: en cok kazand?ran slot oyunlar? – slot siteleri

ilk giriЕџte bonus veren bahis siteleri

Canl? Casino Siteleri: casino bahis siteleri – en guvenilir casino siteleri

az parayla cok kazandiran slot oyunlar?: slot siteleri – en kazancl? slot oyunlar?

https://slotsiteleri25.com/# slot oyunlar?

sweet bonanza slot sweet bonanza kazanma saatleri sweet bonanza giris

sweet bonanza giris: sweet bonanza guncel – sweet bonanza demo oyna

deneme bonusu veren siteler: denemebonusuverensiteler25 – denemebonusuverensiteler25

slot siteleri slot casino siteleri guvenilir slot siteleri

slot siteleri: guvenilir slot siteleri – guvenilir slot siteleri

https://denemebonusuverensiteler25.com/# deneme bonusu veren siteler

sweet bonanza sweet bonanza kazanma saatleri sweet bonanza demo oyna

Casino Siteleri: yeni aГ§Д±lan bahis siteleri – casino bahis siteleri

denemebonusuverensiteler25: yeni deneme bonusu veren siteler – yeni deneme bonusu veren siteler

https://slotsiteleri25.com/# en kazancl? slot oyunlar?

slot siteleri en cok kazand?ran slot oyunlar? guvenilir slot siteleri

denemebonusuverensiteler25: deneme bonusu veren yeni siteler – yeni deneme bonusu veren siteler

slot siteleri slot oyunlar? slot casino siteleri

slot oyunlar?: slot oyunlar? puf noktalar? – slot oyunlar? puf noktalar?

http://denemebonusuverensiteler25.com/# denemebonusuverensiteler25

Deneme Bonusu Veren Siteler Casino Siteleri en guvenilir casino siteleri

legit canadian online pharmacy https://canadianmdpharm.shop/# pharmacy rx world canada

india pharmacy

mexican drugstore online: Mexican Easy Pharm – purple pharmacy mexico price list

reputable canadian online pharmacy https://canadianmdpharm.shop/# canada drugs

Online medicine order

medication canadian pharmacy canadian pharmacy reviews canadian pharmacy online ship to usa

Indian Cert Pharm: Online medicine – Indian Cert Pharm

reputable canadian online pharmacy: certified canadian pharmacy – northwest pharmacy canada

buy canadian drugs https://canadianmdpharm.shop/# canadian pharmacy in canada

buy prescription drugs from india

canadian pharmacy online https://indiancertpharm.com/# Indian Cert Pharm

online shopping pharmacy india

canadian discount pharmacy: Canadian Md Pharm – best canadian online pharmacy

isotretinoin order – buy dexona pills linezolid 600mg ca

indian pharmacy: Best Indian pharmacy – Indian pharmacy that ships to usa

canadian pharmacy prices Canadian Md Pharm onlinecanadianpharmacy

canadian pharmacy scam https://canadianmdpharm.shop/# pharmacy com canada

indian pharmacy

pharmacies in mexico that ship to usa: Mexican Easy Pharm – mexican mail order pharmacies

mexican online pharmacies prescription drugs Mexican Easy Pharm Mexican Easy Pharm

Mexican Easy Pharm: best online pharmacies in mexico – mexico pharmacies prescription drugs

purchase amoxil for sale – valsartan 160mg for sale buy combivent 100 mcg generic

Indian pharmacy that ships to usa: Indian pharmacy international shipping – Online medicine

the canadian pharmacy https://mexicaneasypharm.com/# buying from online mexican pharmacy

indian pharmacy paypal

indian pharmacy: IndianCertPharm – Best Indian pharmacy

reputable mexican pharmacies online: best online pharmacies in mexico – mexican border pharmacies shipping to usa

best mail order pharmacy canada Canadian Md Pharm canadian pharmacy meds

my canadian pharmacy review: canadian online drugs – canada pharmacy world

canadian neighbor pharmacy https://mexicaneasypharm.com/# medicine in mexico pharmacies

best india pharmacy

Mexican Easy Pharm: Mexican Easy Pharm – mexican border pharmacies shipping to usa

Mexican Easy Pharm: reputable mexican pharmacies online – Mexican Easy Pharm

canadian pharmacy antibiotics: CanadianMdPharm – canadian pharmacy sarasota

india pharmacy Indian Cert Pharm Online pharmacy

IndianCertPharm: Indian Cert Pharm – Online pharmacy

canadian drugs online https://indiancertpharm.com/# Indian pharmacy that ships to usa

Online medicine order

www canadianonlinepharmacy: CanadianMdPharm – canadian neighbor pharmacy

https://mexicaneasypharm.com/# medicine in mexico pharmacies

canadian drug prices

Indian Cert Pharm: mail order pharmacy india – Best online Indian pharmacy

canadian pharmacy antibiotics: canadapharmacyonline legit – canada pharmacy online

buying from online mexican pharmacy: pharmacies in mexico that ship to usa – Mexican Easy Pharm

best india pharmacy: Online medicine – Indian Cert Pharm

Indian pharmacy that ships to usa: Indian pharmacy that ships to usa – Indian pharmacy that ships to usa

Online medicine: Indian Cert Pharm – Indian Cert Pharm

Mexican Easy Pharm: mexican border pharmacies shipping to usa – Mexican Easy Pharm

Indian Cert Pharm: IndianCertPharm – Indian Cert Pharm

canadianpharmacyworld: CanadianMdPharm – canadian pharmacy no scripts

Indian pharmacy that ships to usa: Indian pharmacy international shipping – Indian pharmacy international shipping

reliable canadian pharmacy reviews https://canadianmdpharm.com/# pharmacy rx world canada

online pharmacy india

IndianCertPharm: Online medicine – top online pharmacy india

canadian pharmacy price checker: CanadianMdPharm – canadian pharmacies comparison

indian pharmacy: Online medicine – Indian Cert Pharm

indian pharmacy: Online medicine – indian pharmacy

IndianCertPharm: Indian pharmacy that ships to usa – Online pharmacy

best canadian pharmacy to order from: Canadian Md Pharm – pharmacy wholesalers canada

mexico drug stores pharmacies: Mexican Easy Pharm – Mexican Easy Pharm

legitimate canadian mail order pharmacy: canadian pharmacy – my canadian pharmacy rx

canadian pharmacy india: CanadianMdPharm – canada pharmacy online

pharmacies in mexico that ship to usa: Mexican Easy Pharm – Mexican Easy Pharm

canadian pharmacy victoza: CanadianMdPharm – canadian pharmacy com

https://mexicaneasypharm.shop/# mexico pharmacies prescription drugs

canadian pharmacy

Mexican Easy Pharm: mexican online pharmacies prescription drugs – mexican pharmaceuticals online

Best Indian pharmacy: Best online Indian pharmacy – IndianCertPharm

buying from online mexican pharmacy: Mexican Easy Pharm – mexican online pharmacies prescription drugs

indian pharmacy Online medicine Indian pharmacy international shipping

Online medicine: Best online Indian pharmacy – IndianCertPharm

Mexican Easy Pharm: mexico drug stores pharmacies – Mexican Easy Pharm

pharmacies in canada that ship to the us: CanadianMdPharm – online canadian drugstore

legal to buy prescription drugs from canada: CanadianMdPharm – canadian pharmacy 24h com safe

Online medicine: Indian Cert Pharm – Indian pharmacy that ships to usa

northwest pharmacy canada online canadian drugstore canadian drug

medicine in mexico pharmacies https://mexicaneasypharm.com/# Mexican Easy Pharm

reputable mexican pharmacies online

legit canadian pharmacy: legitimate canadian online pharmacies – canadian pharmacy phone number

Indian Cert Pharm: pharmacy website india – best online pharmacy india

п»їbest mexican online pharmacies https://mexicaneasypharm.com/# reputable mexican pharmacies online

buying prescription drugs in mexico

canadian pharmacy in canada: Canadian Md Pharm – canadian 24 hour pharmacy

mexico drug stores pharmacies buying from online mexican pharmacy mexican online pharmacies prescription drugs

Indian pharmacy that ships to usa: Best online Indian pharmacy – Best online Indian pharmacy

medicine in mexico pharmacies https://mexicaneasypharm.com/# Mexican Easy Pharm

mexico drug stores pharmacies

legal to buy prescription drugs from canada: pet meds without vet prescription canada – legit canadian pharmacy

Kama Pharm: Kama Pharm – cheap kamagra

buy prednisone online without a prescription: buy prednisone 10mg online – Pred Pharm

https://dappharm.com/# Priligy tablets

buy prednisone canada

Pred Pharm prednisone 10mg prices Pred Pharm

buy cytotec online: buy cytotec online – buy cytotec online

over the counter prednisone cream: PredPharm – prednisone generic brand name

https://dappharm.shop/# cheap priligy

prednisone 10 mg

cheap priligy: buy dapoxetine online – buy priligy

п»їcytotec pills online: Cyt Pharm – buy misoprostol over the counter

buy Kamagra Kama Pharm Kama Pharm

https://kamapharm.com/# Kama Pharm

prednisone in uk

PredPharm: prednisone 20mg price – generic over the counter prednisone

buy dapoxetine online: dapoxetine price – buy dapoxetine online

Kama Pharm buy kamagra online usa Kamagra 100mg price

buy kamagra online usa: Kamagra 100mg – Kama Pharm

Kama Pharm: Kama Pharm – Kama Pharm

http://predpharm.com/# Pred Pharm

cost of prednisone tablets

semaglutide best price: generic rybelsus tabs – buy rybelsus online

PredPharm: prednisone brand name canada – prednisone for sale in canada

prednisone 60 mg order prednisone 10mg 50mg prednisone tablet

semaglutide tablets for weight loss: SemaPharm24 – buy semaglutide

http://predpharm.com/# Pred Pharm

can you buy prednisone in canada

semaglutide best price: SemaPharm24 – semaglutide tablets

dapoxetine price: dapoxetine online – priligy

semaglutide tablets for weight loss semaglutide tablets semaglutide best price

PredPharm: cost of prednisone 10mg tablets – prednisone for sale online

https://semapharm24.com/# semaglutide best price

5mg prednisone

dapoxetine price: Priligy tablets – DapPharm

Kama Pharm: Kama Pharm – buy Kamagra

PredPharm prednisone 20 mg over the counter prednisone cream

super kamagra: Kama Pharm – Kamagra 100mg price

Sema Pharm 24: buy semaglutide – Sema Pharm 24

https://predpharm.com/# cost of prednisone 10mg tablets

prednisone 2.5 mg price

Pred Pharm: medicine prednisone 10mg – prednisone 5mg capsules

buy prednisone canadian pharmacy: prednisone sale – PredPharm

Kama Pharm Kamagra tablets Kama Pharm

Priligy tablets: buy priligy – buy dapoxetine online

https://dappharm.com/# dap pharm

buy prednisone online canada

Kama Pharm: Kamagra tablets – Kamagra 100mg

generic rybelsus tabs: buy rybelsus online – SemaPharm24

CytPharm Cyt Pharm Cyt Pharm

Pred Pharm: PredPharm – prednisone 40 mg price

https://kamapharm.com/# Kamagra Oral Jelly

prednisone

CytPharm: buy cytotec over the counter – buy cytotec

Kama Pharm: sildenafil oral jelly 100mg kamagra – Kama Pharm

п»їcytotec pills online: Cyt Pharm – buy misoprostol over the counter

DapPharm cheap priligy dapoxetine online

https://dappharm.shop/# cheap priligy

generic prednisone 10mg

Cyt Pharm: Cyt Pharm – CytPharm

cheap semaglutide pills: semaglutide tablets price – semaglutide best price

buy dapoxetine online: DapPharm – dapoxetine price

Kama Pharm Kama Pharm Kama Pharm

https://kamapharm.shop/# buy Kamagra

buy prednisone online uk

Priligy tablets: cheap priligy – cheap priligy

Kamagra tablets: Kama Pharm – Kama Pharm

Priligy tablets: Priligy tablets – dapoxetine online

semaglutide tablets price: buy rybelsus online – rybelsus semaglutide tablets

http://predpharm.com/# PredPharm

purchase prednisone no prescription

buy misoprostol over the counter buy cytotec online buy cytotec online

semaglutide best price: cheap semaglutide pills – semaglutide tablets

dapoxetine online: priligy – cheap priligy

https://predpharm.shop/# order prednisone 100g online without prescription

Kamagra 100mg price

https://dappharm.com/# buy priligy

prednisone otc uk

priligy: dap pharm – buy priligy

buy cytotec online: cytotec buy online usa – buy cytotec online

buy cytotec in usa: buy cytotec pills online cheap – cytotec abortion pill

http://kamapharm.com/# Kama Pharm

prednisone 20mg buy online

buy cytotec online buy cytotec over the counter Cyt Pharm

order cytotec online: buy cytotec online fast delivery – Cyt Pharm

comprare farmaci online con ricetta: Farma Prodotti – top farmacia online

Farmacie online sicure

farmacie online sicure: Cialis generico – Farmacia online piГ№ conveniente

https://farmasilditaly.shop/# alternativa al viagra senza ricetta in farmacia

farmacie online affidabili

viagra 100 mg prezzo in farmacia: Farma Sild Italy – viagra originale in 24 ore contrassegno

farmacia online

alternativa al viagra senza ricetta in farmacia viagra viagra pfizer 25mg prezzo

farmacia online piГ№ conveniente: Ibuprofene 600 prezzo senza ricetta – farmacia online senza ricetta

Farmacie online sicure: FarmaBrufen – acquistare farmaci senza ricetta

top farmacia online

https://farmasilditaly.com/# viagra generico in farmacia costo

farmacie online affidabili

farmacia online senza ricetta: Brufen senza ricetta – top farmacia online

cialis farmacia senza ricetta viagra generico miglior sito dove acquistare viagra

п»їFarmacia online migliore: Cialis generico – acquistare farmaci senza ricetta

acquisto farmaci con ricetta

https://farmasilditaly.shop/# viagra generico recensioni

п»їFarmacia online migliore

farmacie online sicure: Farmacia online miglior prezzo – comprare farmaci online all’estero

viagra online spedizione gratuita: viagra cosa serve – miglior sito per comprare viagra online

Farmacie on line spedizione gratuita

farmacia online senza ricetta Brufen senza ricetta farmacie online sicure

Farmacia online miglior prezzo: Brufen senza ricetta – farmacie online sicure

https://farmatadalitaly.com/# migliori farmacie online 2024

comprare farmaci online all’estero

farmacia online senza ricetta: Brufen senza ricetta – farmacie online autorizzate elenco

acquisto farmaci con ricetta

farmacia online senza ricetta: Cialis senza ricetta – acquisto farmaci con ricetta

miglior sito dove acquistare viagra: Viagra – alternativa al viagra senza ricetta in farmacia

farmaci senza ricetta elenco

top farmacia online FarmTadalItaly Farmacie online sicure

viagra generico recensioni: FarmaSildItaly – farmacia senza ricetta recensioni

comprare farmaci online con ricetta

acquistare farmaci senza ricetta: Brufen senza ricetta – п»їFarmacia online migliore

acquisto farmaci con ricetta: BRUFEN prezzo – п»їFarmacia online migliore

Farmacie on line spedizione gratuita

Farmacia online miglior prezzo Cialis generico top farmacia online

farmacie online sicure: Farm Tadal Italy – acquistare farmaci senza ricetta

farmacia online: Farma Brufen – comprare farmaci online con ricetta

migliori farmacie online 2024

viagra 100 mg prezzo in farmacia: Farma Sild Italy – alternativa al viagra senza ricetta in farmacia

farmacie online autorizzate elenco

Farmacie online sicure: Farma Prodotti – Farmacie on line spedizione gratuita

viagra pfizer 25mg prezzo viagra originale recensioni viagra online spedizione gratuita

viagra pfizer 25mg prezzo: Farma Sild Italy – siti sicuri per comprare viagra online

farmacie online autorizzate elenco

viagra generico sandoz: FarmaSildItaly – pillole per erezione in farmacia senza ricetta

acquistare farmaci senza ricetta: Cialis generico farmacia – comprare farmaci online con ricetta

farmacia online

Farmacia online miglior prezzo Cialis generico farmacie online sicure

viagra online spedizione gratuita: miglior sito dove acquistare viagra – viagra online consegna rapida

farmacie online sicure: farmacia online piГ№ conveniente – acquisto farmaci con ricetta

migliori farmacie online 2024

acquisto farmaci con ricetta: Farma Prodotti – farmacia online senza ricetta

Farmacia online miglior prezzo: Cialis generico prezzo – migliori farmacie online 2024

comprare farmaci online con ricetta

cialis farmacia senza ricetta viagra online siti sicuri viagra online in 2 giorni

viagra originale in 24 ore contrassegno: Farma Sild Italy – viagra ordine telefonico

viagra online in 2 giorni: viagra online spedizione gratuita – kamagra senza ricetta in farmacia

top farmacia online

farmacia online: Farma Prodotti – acquistare farmaci senza ricetta

miglior sito dove acquistare viagra viagra senza ricetta viagra generico recensioni

Farmacie on line spedizione gratuita: farmaci senza ricetta elenco – Farmacia online piГ№ conveniente

acquistare farmaci senza ricetta

top farmacia online: Ibuprofene 600 prezzo senza ricetta – top farmacia online

migliori farmacie online 2024 Brufen senza ricetta top farmacia online

acquistare farmaci senza ricetta: Farma Prodotti – comprare farmaci online all’estero

migliori farmacie online 2024

Las reservas en lГnea son fГЎciles y rГЎpidas.: winchile.pro – winchile.pro

The casino industry supports local economies significantly.: taya365 com login – taya365 com login

phmacao club phmacao casino The casino atmosphere is thrilling and energetic.

Gaming regulations are overseen by PAGCOR.: phmacao – phmacao club

Algunos casinos tienen programas de recompensas.: winchile casino – winchile casino

Los casinos ofrecen entretenimiento en vivo.: winchile – winchile casino

Loyalty programs reward regular customers generously.: phtaya – phtaya login

jugabet jugabet casino Los jugadores deben conocer las reglas.

Slot tournaments create friendly competitions among players.: phmacao com – phmacao

A variety of gaming options cater to everyone.: taya777 app – taya777 login

Loyalty programs reward regular customers generously.: phmacao – phmacao club

Casino promotions draw in new players frequently.: phmacao.life – phmacao casino

jugabet jugabet Los juegos en vivo ofrecen emociГіn adicional.

Many casinos host charity events and fundraisers.: phtaya.tech – phtaya

Slot machines feature various exciting themes.: taya777 register login – taya777 app

taya365 login taya365.art The Philippines has several world-class integrated resorts.

La historia del juego en Chile es rica.: jugabet casino – jugabet chile

The gaming floors are always bustling with excitement.: taya777 login – taya777 register login

Players enjoy both fun and excitement in casinos.: phtaya casino – phtaya.tech

Many casinos host charity events and fundraisers.: phtaya – phtaya.tech

phtaya phtaya casino Responsible gaming initiatives are promoted actively.

Las estrategias son clave en los juegos.: jugabet.xyz – jugabet

Los casinos son lugares de reuniГіn social.: jugabet casino – jugabet casino

A variety of gaming options cater to everyone.: phtaya – phtaya casino

Los bonos de bienvenida son generosos.: jugabet – jugabet casino

jugabet casino jugabet casino Los casinos organizan eventos especiales regularmente.

Casinos offer delicious dining options on-site.: taya777.icu – taya777 register login

Muchos casinos tienen salas de bingo.: winchile.pro – winchile casino

Most casinos offer convenient transportation options.: phmacao com login – phmacao casino

The thrill of winning keeps players engaged.: taya777 app – taya777 register login

jugabet jugabet Los casinos organizan eventos especiales regularmente.

The Philippines offers a rich gaming culture.: phtaya login – phtaya login

Manila is home to many large casinos.: phtaya.tech – phtaya casino

High rollers receive exclusive treatment and bonuses.: phmacao.life – phmacao casino

phtaya login phtaya.tech Many casinos provide shuttle services for guests.

Poker rooms host exciting tournaments regularly.: taya365 login – taya365 login

The ambiance is designed to excite players.: taya777.icu – taya777

Live dealer games enhance the casino experience.: taya365.art – taya365

Gambling can be a social activity here.: phtaya login – phtaya login

win chile winchile.pro La Г©tica del juego es esencial.

Las apuestas deportivas tambiГ©n son populares.: winchile – win chile

Las reservas en lГnea son fГЎciles y rГЎpidas.: jugabet – jugabet

zithromax 500mg drug – bystolic pill nebivolol 5mg tablet

Players enjoy both fun and excitement in casinos.: phtaya casino – phtaya login

taya777 login taya777 app Players enjoy both fun and excitement in casinos.

Players enjoy a variety of table games.: taya365 login – taya365

Casino promotions draw in new players frequently.: taya365.art – taya365 login

Gaming regulations are overseen by PAGCOR.: taya777 – taya777

Many casinos host charity events and fundraisers.: phtaya – phtaya.tech

taya365 com login taya365.art Game rules can vary between casinos.

buy generic omnacortil 5mg – omnacortil 10mg brand buy prometrium pill

The Philippines has a vibrant nightlife scene.: taya777 login – taya777.icu

Los casinos son lugares de reuniГіn social.: jugabet.xyz – jugabet.xyz

mexican rx online: mexican drugstore online – purple pharmacy mexico price list

canada pharmacy online legit: safe online pharmacies in canada – canadian pharmacy near me

canada pharmacy coupon drugmart discount drugs

easy canadian pharm: easy canadian pharm – safe canadian pharmacy

discount drugs: canadian pharmacy no prescription needed – discount drug mart pharmacy

uk pharmacy no prescription: drug mart – drugmart

easy canadian pharm: northwest canadian pharmacy – canadian pharmacy com

easy canadian pharm canadian pharmacies comparison adderall canadian pharmacy

best canadian pharmacy online: easy canadian pharm – canadapharmacyonline

northern pharmacy canada: easy canadian pharm – buy drugs from canada

discount drug mart pharmacy: drugmart – prescription drugs online

MegaIndiaPharm: MegaIndiaPharm – MegaIndiaPharm

Mega India Pharm MegaIndiaPharm MegaIndiaPharm

medication from mexico pharmacy: xxl mexican pharm – xxl mexican pharm

discount drug mart pharmacy: discount drug mart pharmacy – drug mart

family pharmacy: Best online pharmacy – Cheapest online pharmacy

xxl mexican pharm xxl mexican pharm best online pharmacies in mexico

cheapest pharmacy for prescriptions: canadian pharmacy coupon code – Best online pharmacy

xxl mexican pharm: xxl mexican pharm – mexico pharmacies prescription drugs

family pharmacy: family pharmacy – Online pharmacy USA

Best online pharmacy Cheapest online pharmacy Cheapest online pharmacy

family pharmacy: family pharmacy – family pharmacy

xxl mexican pharm: pharmacies in mexico that ship to usa – mexico drug stores pharmacies

discount drugs: drug mart – discount drug mart

indianpharmacy com: best online pharmacy india – MegaIndiaPharm

Cheapest online pharmacy Cheapest online pharmacy Best online pharmacy

Mega India Pharm: Mega India Pharm – Mega India Pharm

canadian neighbor pharmacy: easy canadian pharm – canadadrugpharmacy com

foreign pharmacy no prescription: drugstore com online pharmacy prescription drugs – Best online pharmacy

no prescription required pharmacy Cheapest online pharmacy cheapest pharmacy to fill prescriptions with insurance

canada drugs online reviews: easy canadian pharm – easy canadian pharm

family pharmacy: Cheapest online pharmacy – Cheapest online pharmacy

family pharmacy: Cheapest online pharmacy – family pharmacy

drug mart: discount drugs – discount drug pharmacy

Online pharmacy USA Cheapest online pharmacy online pharmacy delivery usa

discount drugs: drug mart – drugmart

Mega India Pharm: top online pharmacy india – pharmacy website india

Mega India Pharm: MegaIndiaPharm – MegaIndiaPharm

Mega India Pharm: Mega India Pharm – MegaIndiaPharm

MegaIndiaPharm Mega India Pharm Mega India Pharm

MegaIndiaPharm: MegaIndiaPharm – india pharmacy

Best online pharmacy: family pharmacy – online pharmacy delivery usa

no prescription needed canadian pharmacy https://discountdrugmart.pro/# drugmart

canadian drug: easy canadian pharm – precription drugs from canada

xxl mexican pharm reputable mexican pharmacies online п»їbest mexican online pharmacies

xxl mexican pharm: mexican pharmaceuticals online – xxl mexican pharm

Mega India Pharm: top 10 pharmacies in india – п»їlegitimate online pharmacies india

mail order pharmacy india MegaIndiaPharm MegaIndiaPharm

discount drug mart pharmacy: discount drug pharmacy – discount drug mart

https://slot88.company/# Kasino di Indonesia menyediakan hiburan yang beragam

Slot menjadi bagian penting dari industri kasino: preman69 slot – preman69.tech

slot88.company slot 88 Slot memberikan kesempatan untuk menang besar

https://preman69.tech/# Jackpot progresif menarik banyak pemain

Kasino sering mengadakan turnamen slot menarik: preman69 slot – preman69 slot

http://garuda888.top/# Pemain sering berbagi tips untuk menang

Slot klasik tetap menjadi favorit banyak orang: bonaslot.site – BonaSlot

garuda888.top garuda888 Slot modern memiliki grafik yang mengesankan

https://bonaslot.site/# Slot menawarkan berbagai jenis permainan bonus

Kasino di Indonesia menyediakan hiburan yang beragam: slot88.company – slot 88

https://bonaslot.site/# Jackpot besar bisa mengubah hidup seseorang

slot 88 slot88 Slot klasik tetap menjadi favorit banyak orang

Mesin slot sering diperbarui dengan game baru: slot 88 – slot 88

Slot dengan tema budaya lokal menarik perhatian: BonaSlot – bonaslot.site

Slot dengan tema budaya lokal menarik perhatian https://bonaslot.site/# Permainan slot mudah dipahami dan menyenangkan

https://bonaslot.site/# Kasino memastikan keamanan para pemain dengan baik

slot88 slot88.company Banyak pemain mencari mesin dengan RTP tinggi

п»їKasino di Indonesia sangat populer di kalangan wisatawan: bonaslot – BonaSlot

https://slotdemo.auction/# Pemain sering mencoba berbagai jenis slot

Slot memberikan kesempatan untuk menang besar: bonaslot.site – bonaslot.site

http://preman69.tech/# п»їKasino di Indonesia sangat populer di kalangan wisatawan

generic lasix – oral lasix 40mg betamethasone 20gm us

slot demo gratis demo slot pg Jackpot besar bisa mengubah hidup seseorang

Jackpot progresif menarik banyak pemain: preman69 slot – preman69

https://slotdemo.auction/# Banyak pemain mencari mesin dengan RTP tinggi

Banyak pemain menikmati bermain slot secara online: garuda888 – garuda888

neurontin 800mg cheap – generic sporanox 100 mg buy itraconazole 100mg generic

http://slotdemo.auction/# Banyak pemain menikmati jackpot harian di slot

Banyak pemain menikmati jackpot harian di slot: slot88.company – slot88.company

preman69 preman69 Slot dengan tema film terkenal menarik banyak perhatian

https://bonaslot.site/# Slot menjadi daya tarik utama di kasino

Mesin slot digital semakin banyak diminati: BonaSlot – bonaslot

http://garuda888.top/# Pemain harus memahami aturan masing-masing mesin

Slot dengan fitur interaktif semakin banyak tersedia: garuda888 slot – garuda888.top

https://slotdemo.auction/# Jackpot besar bisa mengubah hidup seseorang

slot 88 slot88 Beberapa kasino memiliki area khusus untuk slot

Kasino sering memberikan hadiah untuk pemain setia: slot88 – slot 88

https://garuda888.top/# Mesin slot digital semakin banyak diminati

Mesin slot baru selalu menarik minat: bonaslot.site – bonaslot.site

http://slot88.company/# Pemain sering mencoba berbagai jenis slot

preman69 preman69 slot Banyak pemain menikmati jackpot harian di slot

Kasino di Jakarta memiliki berbagai pilihan permainan: slot88.company – slot88.company

http://preman69.tech/# Slot menawarkan kesenangan yang mudah diakses

Mesin slot sering diperbarui dengan game baru: slot demo rupiah – slot demo pg gratis

slot demo slot demo rupiah Slot menjadi daya tarik utama di kasino

Mesin slot baru selalu menarik minat: slot88.company – slot 88

https://preman69.tech/# Slot menjadi daya tarik utama di kasino

Pemain sering mencoba berbagai jenis slot: preman69.tech – preman69.tech

https://slotdemo.auction/# Slot menjadi bagian penting dari industri kasino

slotdemo demo slot pg Pemain bisa menikmati slot dari kenyamanan rumah

Keseruan bermain slot selalu menggoda para pemain: garuda888 – garuda888.top

https://bonaslot.site/# п»їKasino di Indonesia sangat populer di kalangan wisatawan

Kasino sering mengadakan turnamen slot menarik: akun demo slot – demo slot pg

http://garuda888.top/# Slot menawarkan kesenangan yang mudah diakses

doxyhexal doxycycline 100 mg india doxycycline 3142

zithromax: ZithroPharm – zithromax z-pak price without insurance

https://doxhealthpharm.shop/# doxycycline cap price

amoxicillin over the counter in canada: AmoHealthPharm – azithromycin amoxicillin

http://zithropharm.com/# buy zithromax without prescription online

zithromax over the counter Zithro Pharm how to get zithromax

buy doxycycline pills online: doxycycline 20 mg cost – doxycycline prescription cost

https://doxhealthpharm.shop/# doxycycline without rx

where can i buy cheap clomid price: how to buy cheap clomid price – generic clomid without prescription

https://clmhealthpharm.shop/# can you get generic clomid prices

https://doxhealthpharm.shop/# how to get doxycycline without prescription